I remember being told, when I was young, to “take it like a man.” The instruction usually had to do with pain, or treatment related to pain. I remember thinking, “Really? Do I have to? There isn’t another way?”

Now that I am a father I do what of course a father should at times of minor pain or medicine-taking. I say, “Take it like a man.” My son, 11, tries to call my bluff. My daughter, 8, wonders why on earth I want her to act like a man.

Right now, given investors’ fatigue after the 2007 collapse, subsequent run-up and relapse in stocks, the phrase comes to mind in relation to the investment strategy called buy and hold. The darling of investment literature in the ‘90s, buy and hold is based on the idea that you are investing for the long term, and if you just leave your investments alone, you will be rewarded. But what is long term? And what is buy and hold? If you bought up to 2007 and held until now, you surely haven’t been rewarded, and you are certainly feeling the pain. Your questions to your financial advisor since October 2007 may have gone like this:

“Should we get out?”…then, “Should we be doing something different?”…then, “Should we completely redo things?”…then, “Should we invest more than planned?” Each time your advisor says, “No, we have a plan and a process, and you should stick to it.” And each time you say, “Really !? Are you sure? Do I have to?”

You’re caught between not wanting to be your own trader (because you know that won’t work) and being frustrated by the advice not to move your money around every time the market goes up or down a few percent. You feel stuck in a couple of senses, and your brain is saying, “I don’t want to take the pain like a man; I want to do something different this time!”

You are taking action

Your frustration, though, springs from a false assumption—that you are using a buy-and-hold strategy with your mutual funds. On the contrary, unless all your funds are index funds (or index-huggers), you are using an active management strategy, albeit indirectly. And if you have chosen good mutual-fund managers, you are availing yourself of all the experience, expertise, research capabilities and technology that it takes to pursue this active strategy successfully. What’s more, you’re doing it in a smart, cost-effective way.

Good mutual-fund managers are managing their fund’s portfolio, your portfolio by proxy. Again, I’m talking about good managers, not all fund managers. Good managers are actively taking defensive positions to guard against pitfalls they foresee, seizing opportunities they see, dumping investments that seem unlikely to perform, buying others that have more promise given today’s conditions and tomorrow’s likely conditions.

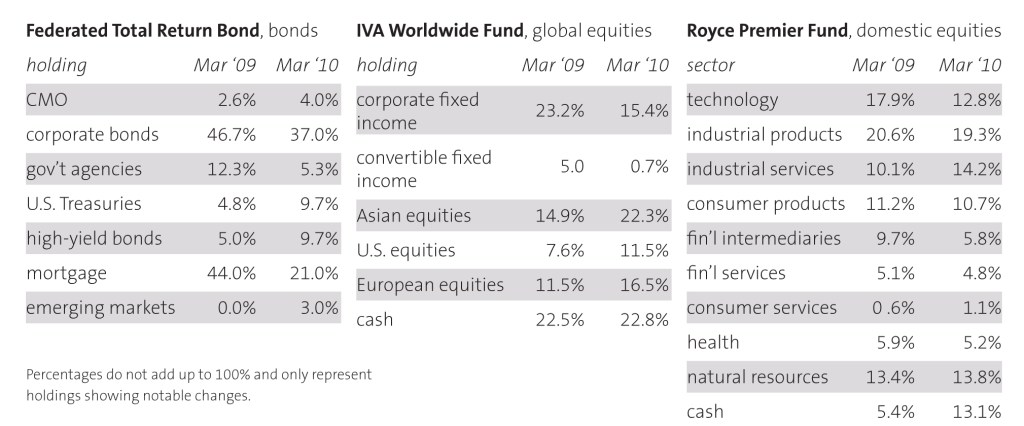

Look at the tables below showing portfolio changes made by three good fund managers between March 2009 and March 2010.

A fund’s turnover is one indicator of how much your manager actively manages the portfolio. Turnover is the percentage of a fund’s holdings that change in a year. For example, if a fund has 25% turnover, one quarter of all holdings are different than they were a year ago. But high turnover is no simple test of good management. On the contrary, it can be costly and ineffective when done poorly. The managers of the Royce Premier Fund, with only 14% turnover, rank among the best.

The critical choice: managers

Finding the good managers is the real task. What qualities should a fund manager have? In his book The Money Masters, John Train says successful managers demonstrate discipline, consistency of application, and independent thought. These are pretty good qualities in both a financial advisor and an investor, I might add. Because choosing the right managers is so critical to achieving your goals, at Allegheny we spend major research and analysis time and discipline identifying the best ones – those we recommend to our clients.

Now, active management doesn’t mean the value of your investment doesn’t decline when the market drops; it may. But investing in a mutual fund also does not consign you to a buy-and-hold, ‘take-it-like-a-man’ strategy either. If you have selected them wisely, your fund managers are analyzing, strategizing, buying, and selling to defend against the worst and capture the upside when it comes. The test of success, remember, is long-term performance. Having good investment managers gives you the best chance to avoid the pain—as well as that test of your manliness—and get the rewards in the long term.

So, what to do?

As you’ve heard me say, we work hard to find great managers who find great holdings. Beyond that, keep these ideas in mind:

- Review what you want your portfolio to do for you – future peace of mind, peace of mind now, the cake, or just icing on the cake.

- Have a purpose for each investment and know the role it plays in your total portfolio.

- Assess your character and temperament as an investor—and what you can handle in market movements.

- Make sure your expectations are based in reality.

- You don’t have to work at your investments every day, but as you delegate to others with expertise, it make sense to know what that expertise is.

Author: David Jeter, CFP®, Allegheny Financial Group, July 2010

Securities offered through Allegheny Investments, LTD, a registered broker/dealer. Member FINRA/SIPC.

The above comments are provided for discussion purposes only and are not meant to be an offer of any specific investment.